According to Parag Khanna, author of âThe Future is Asian: Global Order in the Twenty-first Centuryâ and former strategist and adviser to Obama â the future is not just Asian â but so is the present.

A changing world

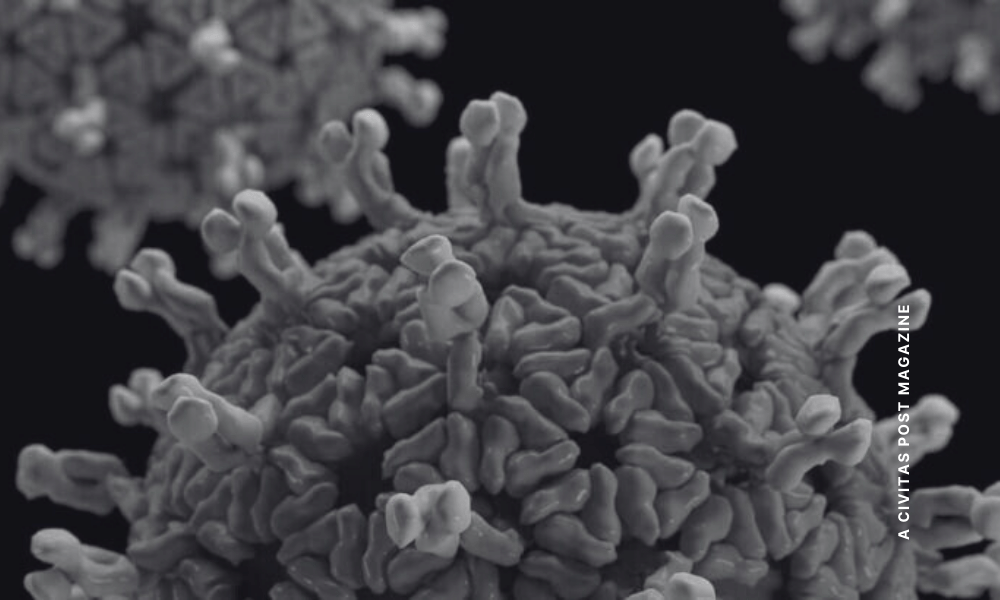

Corona-virus has claimed 3,000 lives and impacted global markets. So, amidst the chaos, we delve into the Asian economies and cast our eyes on the horizon.

Over 50% of the worldâs population lives in Asia and its Purchasing Power Parity (PPP) * is far greater than that of Europe or the US, combined. Asia has repeatedly been quoted as the emerging powerhouse of the world and China is clearly identified as leader of the, at times, disjointed group of nations.

Read More: List & Map of the Top 100 GDP Economies as at 1st Jan 2019

Yet other rapidly growing Asian nations are drawing the attention of the investment community. One example is Bangladesh, who has been attracting an increasing amount (circa 2 Billion USD) of foreign investment and whose economy is expected to continue growing by 6-8% annually.

In an article on Khannaâs âThe Future is Asian : Global Order in the Twenty-first Centuryâ, SCMP detailed how the future for Asia looked, through his eyes:

The farther one looks into the future, therefore, the more clearly Asia appears to be â as has been the norm for most of its history â a multipolar region with numerous confident civilizations evolving largely independent of Western policies but constructively coexisting with one another.

So, is the Future Asian?

Whilst global news outlets are repeatedly underscoring the negative impact coronavirus is currently having on all aspects of life: global mobility, health, economy and social, it would appear we are all glued to our screens scrolling through the nail-biting news and forecasts.

Yet, though the pandemicâs impact is undeniable it is important to highlight the resilience Asia has demonstrated during these testing times. As quoted by SCMP, Michael Blake affirmed that Asiaâs HNWIsâ investment activities are still going strong amidst the chaos. Blake is Union Bancaire Priveeâs regional head and CEO for Asia, overseeing more than 27 Billion Swiss Francs of AUM,

âAsiaâs wealthiest have remained âactively involvedâ in the financial markets and have not rushed to the sidelines as concerns have grown over the effects of the coronavirus outbreak on the regionâs economy, â Michael Blake, Union Bancaire Privee

How much attention therefore should investment migration professionals, wealth managers and private bankers be giving Asia when drawing up their 12-month, 5 year or 10-year business development and growth plans?

First and foremost, itâs important to note that over recent years there has been an irrefutable surge in wealth in China and South East Asia. In parallel, affluent families are becoming increasingly interested in engaging wealth and asset managers to safeguard their wealth. These HNWIâs overriding motivation is to ensure that their burgeoning wealth is future-proofed against; the next global recession, pandemic, political upheaval or (worse) the next generationâs mis-management.

As we highlighted in a recent article on family offices, the demand for these exclusive services is growing, with evermore Asians, predominantly Chinese, establishing their own family office/using a Multiple Family Office (MFO). Prestige Online recently highlighted this trend in an interview with Jaydee Lin, Managing Partner at the Raffles Family Office, a multi-family office providing bespoke asset protection and wealth management solutions.

âĶwhen I started going to China, this family office idea was completely unheard of. A lot of people were misusing this âfamily officeâ term and then do something else like even simply selling insurance. So this word has been used misused a lot of times. Over the last few years, I think it has improved quite a lot and youâll see government initiatives promoting family offices. Jaydee Lin, Raffles Family Office

On the one hand it is quintessential for investment migration professional and succession planning experts to ensure they keep resilient Asia, not only on their radar, but very much at the heart of their business development strategy in both the short and long term. On the other hand, professionals in the investment migration and wealth advisory sectors should ensure that they are continuously developing relationships with the family offices and MFOs that serve the affluent throughout Asia.

The Knight Frank Wealth Report of 2020 issued this week highlights how Asiaâs growth is unstoppable. The report noted that âAsia is quickly closing the gap on Europe and our figures predict that by 2024 it will be the worldâs second largest wealth hub, with forecast five-year growth of 44%. â

Read more: Where is the money? Asia will be the fastest growing wealth hub in 2025

Where are the top wealth hubs for UHNWIs in the next 5 years?

India, topped this ranking with a forecast 73% increase in the number of UHNWIs expected in the country over the next five years. The investment migration industry has already been nose-diving into the Indian market, evidenced by the growing number of industry conferences and summits being held in New Delhi and Mumbai.

Of the top 10 countries listed in the Wealth Report, 5 o were Asian; including Vietnam, China, Indonesia and Malaysia who are all expected to have an exponential increase in their UHNWI (~US$30M+) populations within 5 years. See the graphic below highlighting the forecast for Asiaâs UHNWIs.

Therefore, whilst the world rides the wave of pandemics, social unrest, fear and market volatility we should also keep our eyes on the long-term future â identify growth markets and build strategic professional networks therein.

China will likely continue to lead the region with its numerous initiatives such as the Belt & Road Initiative and Made in China 2025. Those countries that do opt to foster and strengthen ties with the Asian powerhouse, will likely also reap rewards.

As for the rest of the region, numerous economies are speeding ahead in their economic growth and development, notably India and Vietnam, and the present chaos plaguing the world will hopefully be but a speed bump on their journey to growth.

* (PPP) A nationâs GDP at purchasing power parity (PPP) exchange rates is the sum value of all goods and services produced in the country valued at prices prevailing in the United States in the year noted. This is the measure most economists prefer when looking at per-capita welfare and when comparing living conditions or use of resources across countries. (Source: Index Mundi)