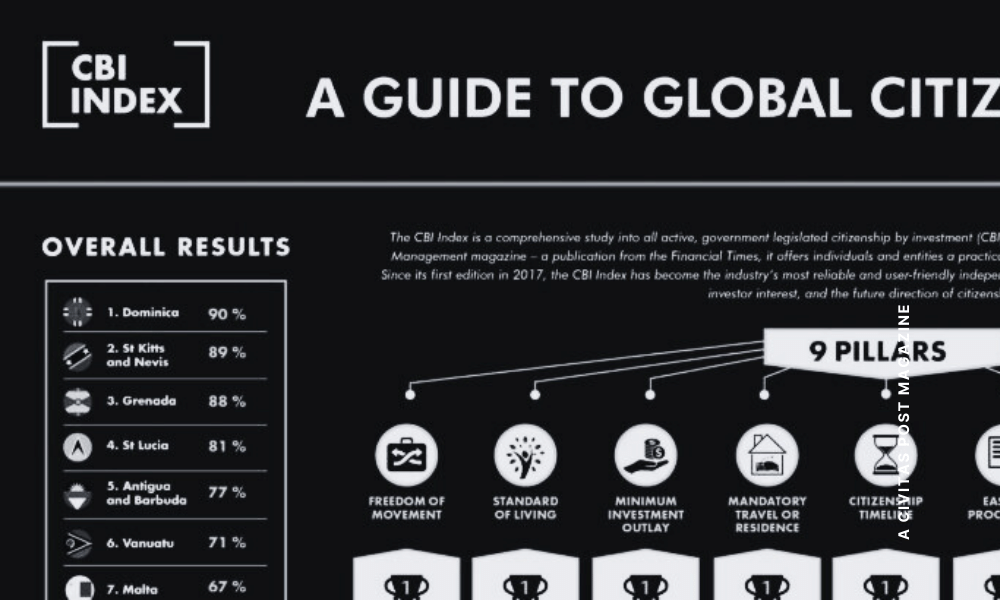

The CBI Index 2020 reviews leading Citizenship by Investment programmes and undertakes a thorough analysis, grading them on the basis of 9 key pillars. Dominica, followed closely by its regional Caribbean counterparts took the lead due to its strong due diligence and low investment threshold.

The citizenship by investment industry is in a state of flux

Existing uncertainties such as economic frailty, the rise of autocratic governments, social turbulence, and geopolitical stress, have been further catalysed by Covid-19 and the resultant global crisis has had a significant impact on the way investors approach the safeguarding of their families and assets

As international travel becomes more restricted and it becomes clearer which countries have the capacity to deal with major health crises, more high net worth individuals are actively exploring alternative citizenship and residence options with a focus on healthcare and a high standard of living.

The CBI Index 2020

Here, few options for citizenship are as expeditious and straightforward as citizenship by investment, and this has resulted in a sizeable uptick in demand in the investment migration industry since the pandemic took hold back in March 2020.

At the same time, more governments are becoming aware of citizenship by investment as an effective mechanism for generating critical revenue and investment during a period of heightened economic turbulence. Taking these factors together, it is becoming increasingly important for investors to have reliable and up-to-date information with which to assess the comparative strengths of a growing number of citizenship by investment programmes.

2020 marks the fourth edition of the CBI Index, a yearly publication from the Financial Times subsidiary, Professional Wealth Management, the only independent study that comprehensively evaluates and compares all active citizenship by investment programmes in the world.

Developed by James McKay, founder of London-based research consultancy McKay Research, the CBI Index serves as a comprehensive and data-driven comparison tool for the worldâs active CBI programmes, providing potential investors with a mechanism for appraising programmes and facilitating their decision-making process.

In the 2020 CBI Index, the CBI programmes of 14 countries are assessed, namely: Antigua and Barbuda, Austria, Bulgaria, Cambodia, Cyprus, Dominica, Grenada, Jordan, Malta, Montenegro, St Kitts and Nevis, St Lucia, Turkey, and Vanuatu. The 2020 edition sees Montenegro feature in the rankings for the first time, having issued its first application approval in the first quarter of the year.

Read more: Dominica Citizenship by Investment holders receive Biometric passport

The Nine CBI Pillars

The CBI Index measures CBI programmes against âpillarsâ that represent key investor priorities. In addition to the seven pillars featured since its inception, the 2020 CBI Index introduces two new pillars: Family and Certainty of Product.

The Family Pillar was conceived to reflect this yearâs central industry trend of family reunification, while the Certainty of Product Pillar was added to absorb previous programme stability measurements and incorporate further considerations such as a programmeâs popularity and renown.

The nine pillars therefore include:

- Freedom of Movement

- Standard of Living

- Minimum Investment Outlay

- Mandatory Travel or Residence

- Citizenship Timeline

- Ease of Processing

- Due Diligence

- Family

- Certainty of Product

Each pillar is scored out of a maximum of 10 points, with 90 being the maximum score attainable by a programme.

Scores are derived from data collected from relevant industry sources including legislation, government circulars and memoranda, official media and statistics channels and direct correspondence with governments and their authorised representatives.

Key findings in the 2020 CBI Index demonstrate that Caribbean CBI programmes outrank the rest of the world, with Dominica, St Kitts and Nevis, Grenada, St Lucia, and Antigua and Barbuda filling the top five positions.

Dominicaâs Programme secured the top ranking for the fourth consecutive year, achieving high scores, among other things, as a result of its strong due diligence and low minimum investment outlay.

In addition to measuring programme features and desirability, the CBI Index brings value to the investment migration industry by discussing the key issues that propel its evolution, including, for example, industry responses to Covid-19, new investor priorities in light of Covid-19, the concepts of âcitizenshipâ and âpassportâ, and the future direction of citizenship by investment.

For more information on the CBI Index visit www.cbiindex.com or email info@cbiindex.com.